Apps

1 day ago

8 Best Free Voice Changer Apps For Android & iOS (2024)

Are you searching for the greatest hilarious applications so you can have some laughs over…

Tech

4 days ago

Top 10 Best Game Recording Software for Windows in 2024

Even if the popularity of consoles may be growing, many players still use PCs for…

Internet

4 days ago

10 Best Image Downloader Chrome Extensions [2024]

The conventional way of storing photographs in Google Chrome has limitations, and users may find…

Apps

4 days ago

Top 10 Best Reminder Apps for Windows [2024 Edition]

The world moves quickly these days, and it’s simple to become bogged down in the…

Games

5 days ago

Top 10 Best Minecraft Servers You Must Check Out

The vast majority of people who play Minecraft concur that the experience of the game…

Internet

5 days ago

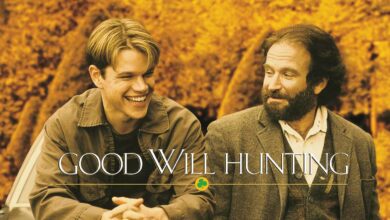

Top 10 Best Inspirational Movies You Shouldn’t Miss

Most of us would have had a “rock bottom” moment at some time in our…

Apps

5 days ago

Top 10 Best Video Editing Apps for iPhone You Can Use

Phones are capable of doing very demanding tasks as their power continuously increases. Because of…

Games

5 days ago

Top 10 Best Google Doodle Games You Should Play [2024]

Google Doodles are unique, transient updates to the company’s logo that are produced to celebrate…

Apps

5 days ago

Top 6 Best Text Editors for Mac in 2024

Apple’s Macs come with TextEdit as the standard text editor. Both macOS and it are…

Apps

5 days ago

Best 10 Contract Management Software to Streamline Workflow

Contracts constitute a company’s income funnel, and contract management software ensures that the channel is…